SustainabilityGovernance

- Basic Policy Regarding

Corporate Governance - Corporate Governance System

Basic Policy Regarding

Corporate Governance

Chapter 1:General rules

- Objectives

-

Article 1

The objectives of this policy shall be to achieve an effective corporate governance as a system for transparent/fair and prompt/bold decision-making that gives due consideration to the situation regarding shareholders / suppliers / employees / local communities (hereinafter referred to as “Stakeholders”), in order to aim for sustainable growth of our company and to improve its medium- and long-term corporate value.

- Basic way of thinking with regard to corporate governance

-

Article 2

- Our company shall always endeavor to achieve effective corporate governance, and continuously work toward the fulfillment of same.

- Our company shall adopt an Audit & Supervisory Committee in order to further improve the supervisory function of the Board of Directors, enhance its deliberation, and expedite its management decision-making.

-

Our company shall work toward the fulfillment of corporate governance mainly from the following viewpoints.

- We shall respect the rights of shareholders and ensure equality;

- We shall take into consideration the interests of Stakeholders, including shareholders, and cooperate appropriately with those Stakeholders;

- We shall disclose company information appropriately and ensure transparency;

- We shall involve independent outside directors and the Audit & Supervisory Committee in important matters such as the appointment/dismissal of candidates to be directors and remuneration for directors, and shall make the supervisory function with regard to the execution of business by the Board of Directors effective;

- We shall have constructive dialog with shareholders who have an investment policy that matches the medium- and long-term interests of shareholders.

Chapter 2:Ensuring the rights/equality of shareholders

- General meetings of shareholders

-

Article 3

- Our company shall deliver notices of the convocation of shareholders at an early date and disclose such notices of convocation on our website, in order to ensure a sufficient period of time for shareholders to examine the agenda items of general meetings of shareholders and be able to exercise their voting rights appropriately.

- Our company shall announce on our website the matters set forth in the notice of convocation between the resolution of the Board of Directors with regard to the general meeting of shareholders and the delivery of the notice of convocation.

- Our company shall as far as possible schedule general meetings of shareholders, avoiding dates when many other companies hold their shareholders meeting to prevent clashing of dates.

- Our company shall endeavor to maintain an environment in which all shareholders, including shareholders who are not present at general meetings of shareholders, will be able to exercise their voting rights appropriately.

- Ensuring the equality of shareholders

-

Article 4

Our company shall treat shareholders equally in accordance to their equity interest, and disclose information in a timely and appropriate manner in order to prevent information gaps from arising.

- Response policy with regard to large-scale purchases of our company’s shares

-

Article 5

- From the viewpoint of ensuring and improving our company’s corporate value and in turn the common interests of our shareholders, our company has introduced anti-takeover measures by which any person who intends to make a large-scale purchase of our company’s share certificates, etc. is required to submit certain information with regard to such purchase, and which enable requiring the securing of a period of time for our company’s Board of Directors to examine such purchase offer, negotiate with the purchaser, and if necessary present an alternative proposal to shareholders, so as those shareholders will be able to judge appropriately whether or not to accept such purchase.

- The introduction of such anti-takeover measures was carried out by obtaining approval at a general meeting of shareholders after thorough examination of their necessity and rationality at meetings of the Board of Directors and of the Audit & Supervisory Board, and the same procedures are followed when they are due for renewal every three years. Furthermore, with regard to the operation of such anti-takeover measures, the stipulated rules shall be complied with, thorough examination shall be conducted at meetings of the Board of Directors and of the Audit & Supervisory Committee in the light of the objectives set forth in the previous clause, and disclosures shall be made to shareholders in a timely and appropriate manner.

- Basic policy regarding the exercising of voting rights pertaining to cross-shareholding of shares and to cross-shareholding shares

-

Article 6

- Our company may acquire and hold shares of its clients in order to build good business relationships with them and promote business smoothly.

- With regard to the shares of our clients, our company shall verify whether the objectives are appropriate, whether benefits and risks of holding them are fair to the capital cost, etc. and when shares are considered to have poor significance of holding, we shall sell them promptly while closely watching share prices and market trends.

- When exercising voting rights pertaining to shareholdings, our company shall consider separately whether they will contribute to improving the medium- and long-term corporate value of companies of which our company holds shares and our company’s medium- and long-term corporate value, and decide to approve or disapprove agenda items on the basis of the results.

- Roles of corporate pension funds as asset owners

-

Article 7

Our company adopts a defined-benefit corporate pension plan and entrusts the management of the reserved fund to an outside investment institution. Our company shall issue the basic policy regarding the management of the reserved fund and management guideline. Furthermore, we shall monitor the entrusted investment institution’s management performance monthly. When conflicts of interests arise between a beneficiary of the corporate pension plan and our company, we shall manage them in accordance with the “Takihyo Defined-Benefit Corporate Pension Plan Code”.

- Transactions between related parties

-

Article 8

In the event that a problem pertaining to conflict of interest between our company’s officers and major shareholders arises, pursuant to the “Rules of the Board of Directors”, it must be reported to the Board of Directors promptly and approval of the Board of Directors must be obtained.

Chapter 3:Appropriate cooperation with Stakeholders

- Ethical standards

-

Article 9

With regard to appropriate cooperation with Stakeholders, respecting their interests, and sound corporate activity, our company shall, on the basis of its management philosophy/management principles, separately stipulate and disclose ethical guidelines/rules of conduct, etc. with which our directors, executive officers, employees, etc. must comply.

- Securing in-house diversity

-

Article 10

Our company shall recruit diverse human resources regardless of gender/nationality/age, develop them and secure opportunities for them to use their skills, on the basis of an awareness that leveraging diverse viewpoints and sets of values is necessary for sustainable growth and the improvement of the medium- and long-term corporate value.

- Appropriate operation of an internal reporting system

-

Article 11

- As a point of contact for employees for consultations or reporting with regard to organizational or individual breaches of laws, violations of company regulations, etc., our company shall establish “Takihyo Hot Line”, for which a third party that is independent from our company will be the point of contact.

- Pursuant to the provisions of the “Rules for Handling Internal Reporting”, our company shall not subject reporters to any disadvantageous handling. Furthermore, the names of reporters shall be concealed in response to their requests.

- The departments responsible for legal/compliance shall endeavor to verify the details of reports objectively, take measures to correct breaches and to prevent recurrence according to their materiality, and report to the Board of Directors.

- Approach to sustainability

-

Article 12

In order to achieve sustainable growth and the improvement of medium- and long-term corporate value, our company shall respect the interests of various Stakeholders, give appropriate consideration to the sustainability of the environment and society, and contribute to it actively, in all processes pertaining to our company’s business activity.

Chapter 4:Ensuring appropriate information disclosure and transparency

- Disclosure of basic policy regarding corporate governance

-

Article 13

Our company shall pass resolutions on and disclose “Basic Policy Regarding Corporate Governance” (hereinafter referred to as “this Basic Policy”) through meetings of the Board of Directors. Furthermore, in the event that this Basic Policy is revised, the details shall be disclosed in a timely and appropriate manner.

- Disclosure of policies regarding risk management, internal control systems, etc.

-

Article 14

Pursuant to the Companies Act and other laws, the Board of Directors shall decide our company’s policies regarding risk management, internal control systems, legal compliance, etc. for our company and for the corporate group that includes our company, and shall disclose them in a timely and appropriate manner.

- Disclosure of management principles / business plans, etc.

-

Article 15

In accordance with the Companies Act, with the Financial Instruments and Exchange Act, with other laws and with the regulations of securities exchanges, the Board of Directors shall disclose matters regarding management principles, business plans, finance and the execution of business in a timely and appropriate manner.

- Securing a proper environment for the execution of audits by external auditors

-

Article 16

-

The Audit & Supervisory Committee shall appoint and evaluate external accounting auditors on the basis of the following criteria laid down by the Audit & Supervisory Committee, and confirm that such external accounting auditors have expertise and independence based on applicable laws such as the Certified Public Accountants Act and the Financial Instruments and Exchange Act.

- The validity of the basic policy with regard to audit work, and validity of the important audit items;

- The validity of the number of members, the experience, etc. of the team that will carry out the audit work, and the validity of the support system for audits;

- The validity of the number of days for the audit work and of the concrete method for carrying out the audit, and the rationality of the services included in the audit contract;

- The validity of the estimate for the audit fees and of the estimation method, and the rationality of the method for making changes to fees to accompany changes to the number of days for the audit and the target areas for the audit;

- The record of performance of audits from the viewpoint of scale, type of industry, etc.

-

In order to achieve proper execution of audits by external accounting auditors, the Board of Directors shall maintain an in-house acceptance system from the following viewpoints, and appoint departments responsible for corporate planning, accounting, and internal auditing as points of contact in practice.

- Securing a sufficient period of time necessary to execute the audit work, securing places in which to work, and maintaining the necessary materials;

- The implementation of regular information exchange among external accounting auditors, the president (CEO) and directors responsible for finance, and the setting up of interviews with them if external accounting auditors require it;

- The implementation of regular information exchange among external accounting auditors, Audit & Supervisory Committee and the internal audit department, and the securing of their cooperation if external accounting auditors require it;

- The securing of cooperation with outside directors if external accounting auditors require it;

- In the event that external accounting auditors point out problems and request correction, prompt reporting to the Board of Directors, the examination of concrete counter measures regarding consolidated risk management by meeting bodies, and decisions on counter measures at meetings of the Board of Directors.

-

The Audit & Supervisory Committee shall appoint and evaluate external accounting auditors on the basis of the following criteria laid down by the Audit & Supervisory Committee, and confirm that such external accounting auditors have expertise and independence based on applicable laws such as the Certified Public Accountants Act and the Financial Instruments and Exchange Act.

Chapter 5:Responsibilities of the Board of Directors as a supervising body

- Roles of the Board of Directors

-

Article 17

- The Board of Directors shall be responsible for achieving effective corporate governance, and through that, for our company’s achieving sustainable growth and working to improve medium- and long-term corporate value.

- In order to fulfill the responsibilities set forth in the previous clause, the Board of Directors shall ensure fairness/transparency of management by demonstrating its supervisory function for the overall management, and shall be responsible for conducting the best decision-making through decisions on the appointment of and remuneration for the president (CEO) and other members of management, the assessment of the risks that our company faces and the development of counter measures, and decisions on the execution of important businesses of our company.

- The Board of Directors shall stipulate important matters with regard to management in the “Rules of the Board of Directors” and the “Rules on Authorization for Decision”, shall make judgments/decisions on these matters by themselves, and shall delegate other decision-making pertaining to the execution of business to executive directors and executive officers, for the purposes of prompt and flexible decision-making and the strengthening of the supervision of executive bodies by the Board of Directors.

- Roles of the Audit & Supervisory Committee

-

Article 18

- The Audit & Supervisory Committee, entrusted by shareholders, shall be responsible for audit/supervision of directors executing their duties from an independent and objective standpoint and ensuring sound and sustainable growth of our company.

- In the appointment of external accounting auditors, the Audit & Supervisory Committee shall establish criteria to evaluate its candidates properly and confirm that they have independence and expertise even after they are appointed.

- The Audit & Supervisory Committee shall determine opinions about the appointment, dismissal, and resignation of directors (excluding the directors acting as the Audit & Supervisory Committee members).

- Roles of independent outside directors

-

Article 19

-

The independent outside directors of our company shall assume the following roles and responsibilities.

- They shall actively advise with regard to matters for decision by the Board of Directors on the basis of their own knowledge and experience, from the viewpoint of our company’s sustainable growth and the improvement of medium- and long-term corporate value;

- They shall be involved in important decision-making, such as the appointment/dismissal of candidates to be directors and remuneration for directors;

- They shall supervise with regard to issues pertaining to conflicts of interest, such as transactions between related parties;

- They shall reflect the opinions of Stakeholders, including minority shareholders, appropriately at meetings of the Board of Directors.

-

The independent outside directors of our company shall assume the following roles and responsibilities.

- Chairpersons of meetings of the Board of Directors

-

Article 20

- Chairpersons of meetings of the Board of Directors shall endeavor to stimulate discussion at meetings of the Board of Directors, and to enable meetings of the Board of Directors to operate effectively and efficiently.

- In order to fulfill the responsibilities set forth in the previous clause, Chairpersons of meetings of the Board of Directors shall secure a sufficient period of time for all of the agenda items, and must give consideration so that each director will be able to obtain sufficient information with regard to each agenda item.

Chapter 6:Effectiveness of the Board of Directors

- Structure of the Board of Directors

-

Article 21

- The number of directors (excluding the directors acting as the Audit & Supervisory Committee members) shall be fifteen (15) or less, and the number of directors acting as the Audit & Supervisory Committee members shall be five (5) or less. Furthermore, two (2) of them shall be independent outside directors.

-

The standards regarding the independence of our company’s outside directors (hereinafter referred to as the “Independence Standards”) shall be as follows, on the basis of “Standards for Independence” stipulated by the Tokyo Stock Exchange:

- Not currently falling under or having in the past one (1) year fallen under any of the following persons:

- A client whose annual turnover with our company group exceeds 5% of our company’s consolidated sales, or a director, executive officer, employee or other executor of business stipulated in Article 2, Clause 3, Item 6 of the Ordinance for Enforcement of the Companies Act (hereinafter referred to as the “Executors of Business”) of same;

- A client whose annual turnover with our company group exceeds 5% of its annual consolidated sales, or an Executor of Business of same;

- A financial institution that our company group borrows from and is a lender for which the debt balance of our company group at the end of the business year exceeds 5% of the our consolidated total assets, or an Executor of Business of same;

- An expert, such as an attorney, certified public accountant, tax accountant, or consultant, who has acquired money and other property from our company group other than the officer’s remuneration that exceeds ten (10) million yen in a year. (In cases where the person who has acquired such property is an entity such as a corporate body or association, this shall refer to persons who belong to such entity.)

- Not being a spouse or relative within the second degree of kinship of a person who falls under【1】or【2】of the following:

- A person who is currently or has been in the past five (5) years a director, an executive officer or an employee with a position of manager or above, of our group company, or another person equivalent to these;

- A person who falls under any of the persons set forth in 【1】 to【4】 of (1) above. (The above Executors of Business in 【1】 to【3】of (1) shall be limited to directors, executive officers or employees with a position of manager or above, or to other persons equivalent to these.)

- Not currently falling under or having in the past one (1) year fallen under any of the following persons:

- Qualifications of directors and nomination procedures

-

Article 22

- Directors of our company must be persons of outstanding personality, insight, and capabilities, and who have extensive experience and high ethical standards.

- Our company shall give consideration to the diversity of directors when deciding on candidates to be directors, on the basis of the idea that diversity of gender, age, nationality, skills, etc. will contribute to the achievement of effective corporate governance, the sustainable growth of our company and the improvement of medium- and long-term corporate value.

- Candidates to be directors shall be decided on at meetings of the Board of Directors, after judgment at a meeting of the nomination advisory committee, on the basis of this article.

- Upon the appointment/dismissal of directors (excluding the directors acting as the Audit & Supervisory Committee members), the Audit & Supervisory Committee shall share/discuss the matters confirmed by the nomination advisory committee and confirm whether there are any issues to be appealed at a general meeting of shareholders.

- Qualifications of audit & supervisory board members and nomination procedures

-

Article 23

- Directors acting as the Audit & Supervisory Committee members of our company must be persons of outstanding personality, insight, and capabilities, and who have extensive experience and high ethical standards. At least one (1) of the directors acting as the Audit & Supervisory Committee members of our company must have appropriate knowledge and experience regarding finance/accounting.

- Our company shall give consideration to the diversity of the directors acting as Audit & Supervisory Committee members, on the basis of the way of thinking that diversity of gender, age, nationality, skills, etc. will contribute to the achievement of effective corporate governance.

- Candidates to be directors acting as Audit & Supervisory Committee members shall be decided on at meetings of the Board of Directors, after judgment at a meeting of the nomination advisory committee and agreement of the Audit & Supervisory Committee, on the basis of this article.

- Establishment of a nomination advisory committee and remuneration advisory committee

-

Article 24

- Our company shall establish a nomination advisory committee and remuneration advisory committee as advisory committees for the Board of Directors.

- The nomination advisory committee and the remuneration advisory committee shall consist of the representative director, independent outside directors, and directors acting as Audit & Supervisory Committee members.

- Nomination advisory committee

-

Article 25

The nomination advisory committee shall examine the details of agenda items of general meetings of shareholders regarding the appointment of directors before such agenda items are decided on, and shall advise the Board of Directors. Furthermore, it shall advise the Board of Directors with regard to the details pertaining to Independence Standards.

- Remuneration advisory committee

-

Article 26

The remuneration advisory committee shall examine the details of policy regarding the remuneration, etc. of directors (excluding the directors acting as the Audit & Supervisory Committee members) and of individual remuneration, etc., and shall advise the Board of Directors.

- Succession plans

-

Article 27

When the president (CEO) retires, the Board of Directors shall decide on candidates to be the successor to the president (CEO) on the basis of the opinions of the nomination advisory committee.

- Responsibilities of directors

-

Article 28

- Directors must collect sufficient information to execute their duties and must discuss matters thoroughly, expressing their opinions actively.

- Directors shall demonstrate the capabilities expected of them, spend sufficient time for the sake of our company, and execute their duties as directors.

- On taking up their office, directors of our company must understand our company’s internal rules, including applicable laws, our company’s Articles of Incorporation, and the Rules of the Board of Directors, and must fully recognize their responsibilities.

- Diligent study and training of directors and audit & supervisory board members

-

Article 29

- Directors shall participate in the compliance committees held every two (2) months and acquire necessary knowledge with regard to legal compliance, corporate governance and other important matters regarding management.

- In order to achieve the purpose set forth in the previous clause, departments responsible for legal/compliance shall invite company attorneys and external professionals to the compliance committees and continue to make it an opportunity for directors to acquire expert knowledge.

- In order to fulfill their roles, directors collect information actively and devote themselves to study with regard to our company’s financial condition, legal compliance, corporate governance and other matters. Directors responsible for legal/compliance and directors responsible for accounting shall provide necessary documents and take on the duty of explanation in response to requests from directors.

- Setting the agenda for meetings of the Board of Directors, etc.

-

Article 30

- Prior to a meeting of the Board of Directors, the chairperson of the meeting of the Board of Directors shall consult with directors responsible for corporate planning and set the agenda for the meeting of the Board of Directors.

- The agenda items for a meeting of the Board of Directors and the materials regarding the matters to be reported shall be distributed or sent by electronic means to each director well before the date of the meeting of the Board of Directors, so that a fruitful discussion can be held at the meeting of the Board of Directors. However, this shall not apply to matters of urgency or high confidentiality.

- In order to achieve the purpose set forth in the previous clause, the agenda items of meetings of the Board of Directors shall be deliberated on in advance at management meetings prior to the meetings of the Board of Directors.

- Access to in-house information by independent outside directors and directors acting as Audit & Supervisory Committee members

-

Article 31

- Independent outside directors and directors acting as Audit & Supervisory Committee members may whenever necessary request explanations or reports from executive directors, executive officers and employees, or the submission of in-house documents.

- Our company shall have persons who belong to departments responsible for corporate planning assist independent outside directors when it is necessary in order for them to execute their duties appropriately.

- Our company shall have persons who belong to the Business Audit Office assist the directors acting as Audit & Supervisory Committee members when it is necessary in order for them to execute their duties appropriately, and the persons who belong to the Business Audit Office who are thus entrusted shall follow the instructions of directors acting as the Audit & Supervisory Committee members independently from the directors (excluding the directors acting as the Audit & Supervisory Committee members).

- Our company shall establish the Audit & Supervisory Committee Office and appoint employees to assist the Audit & Supervisory Committee.

- Self-assessment

-

Article 32

The Board of Directors shall analyze and assess the effectiveness of the Board of Directors as a whole every year on the basis of self-assessments by each director, and disclose a summary of the results in a timely and appropriate manner.

Chapter 7:Remuneration system

- Remuneration, etc. of directors

-

Article 33

- Remuneration, etc. of executive directors, etc. shall be appropriate, fair and well-balanced remuneration that can enhance the motivation of such executive directors toward the maximization of our company’s corporate value.

- Our company shall disclose in a timely and appropriate manner the policy regarding remuneration, etc. of directors (excluding the directors acting as the Audit & Supervisory Committee members) that the Board of Directors has decided on in accordance with advice from the remuneration advisory committee pursuant to the provisions of Article 26.

- The remuneration, etc. of independent outside directors must reflect the hours and duties for which each independent outside director is involved in our company’s business, and must not include shares-related remuneration or other performance-based elements.

- The amount of individual remuneration etc. for directors (excluding the directors acting as the Audit & Supervisory Committee members) shall be decided through fair examination and with advice from the remuneration advisory committee, in accordance with the provisions of Article 26.

- In cases where the remuneration advisory committee advises on the amount of individual remuneration etc. for directors (excluding the directors acting as the Audit & Supervisory Committee members.) in accordance with the provisions of Article 26, it shall judge the appropriateness of the amount of remuneration, etc. by taking into consideration the type of work and while referring to remuneration standards of other companies that are appropriate targets for comparison.

- Regarding remuneration of directors (excluding the directors acting as the Audit & Supervisory Committee members), the Audit & Supervisory Committee shall share/discuss the matters confirmed by the remuneration advisory committee and confirm whether there are any issues to be appealed at a general meeting of shareholders.

Chapter 8:Dialog with shareholders

- Dialog with shareholders

-

Article 34

- Our company shall communicate information regarding performance record transitions, management strategy, etc. equally to shareholders, etc. and promote shareholders’ understanding through the holding of regular events, including general meetings of shareholders and information sessions for analysts, institutional investors and individual investors, posting on our website and the publishing of communications for shareholders.

- In the event that our company has received a request for an interview regarding corporate governance and important management policies from a major shareholder with an investment policy that matches the medium- and long-term interests of shareholders, directors or leading members of the departments stipulated in the next clause shall respond to it.

-

In order to achieve the objectives of the previous two (2) clauses, our company shall endeavor to prepare the following systems, and shall appoint the persons responsible as corporate planning directors.

- On the occasion of the dissemination of information and dialogs with shareholders set forth in the previous two (2) clauses, departments responsible for corporate planning, IR, and legal/compliance shall unify explanatory materials and details of responses, upon mutual consultation;

- Departments responsible for IR shall decide an annual schedule for information sessions for investors and IR activities every year, and disclose it through our website, etc.;

- Departments responsible for IR shall summarize shareholders’ opinions and matters of concern on each occasion of an information session for investors and an IR activity, report them to the president and directors, and reflect them in information sessions for investors and IR activities.

- On the occasion of a dialog with shareholders, directors responsible for corporate planning shall judge whether matters fall under internal information or not in advance in accordance with the provisions of the “Regulations for the Prevention of Insider Trading”, and shall give due consideration so as to prevent substantial information gaps from arising among shareholders.

Chapter 9:Other matters

- Revisions

-

Article 35

- Revisions to this policy shall be in accordance with resolutions of the Board of Directors.

- Furthermore, in the event that this Basic Policy is revised, the details shall be disclosed in a timely and appropriate manner.

Established on November 20, 2015

Revised on May 27, 2020

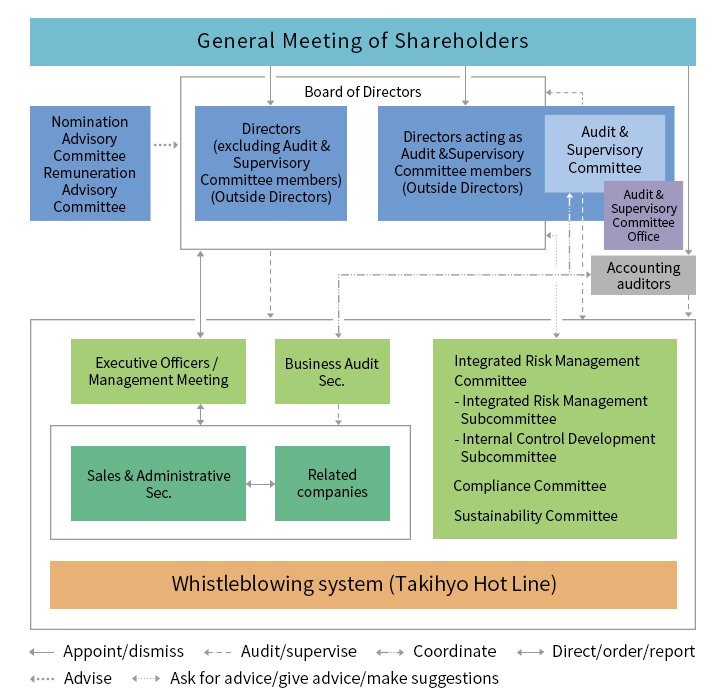

Corporate Governance System

Corporate Governance System

Our company is constantly striving to achieve effective corporate governance, and is continuously working towards the fulfillment of same.

Our company has adopted an Audit & Supervisory Committee in order to further improve the supervisory function of Board of Directors, enhance its deliberation and expedite its management decision-making.

We are working toward the enhancement of corporate governance mainly from the following viewpoints.

- We shall respect the rights of shareholders and ensure equality;

- We shall take into consideration the interests of Stakeholders, including shareholders, and cooperate appropriately with those Stakeholders;

- We shall disclose company information appropriately and ensure transparency;

- We shall involve independent outside directors and the Audit & Supervisory Committee in important matters such as the appointment/dismissal of candidates to be directors and remuneration for directors, and shall make effective the supervisory function with regard to the execution of business by the Board of Directors;

- We shall have constructive dialog with shareholders who have an investment policy that matches the medium- and long-term interests of shareholders.

Corporate Governance System Diagram